LEARN with

A Gamified Financial Education App for Teens

How can PNC educate teens about wealth management, while creating a future customer base?

Finance isn't the most appealing topic to a teen. Most teens lack an understanding of finance due to limited experience with financial decisions.

Additionally, parents often don't know how to effectively teach these concepts, and lack the tools to do so.

Since parents provide the strongest influence on their children’s financial education, there is a great opportunity to provide them with a tool for educating their teens. We need to bring teens closer to banks, while educating teens and empowering parents.

LEarn is designed to to do just that, by allowing parents and children to collectively set purchasing goals and achieve them by completing a customized, modular curriculum.

Client: PNC

Team: Shipra Arora, Bori Lee, Jenny Hu, Shitian Wang, Emily Osborne

How do we fix this?

Why is this a problem?

Click on image to view full prototype

Here's what we created

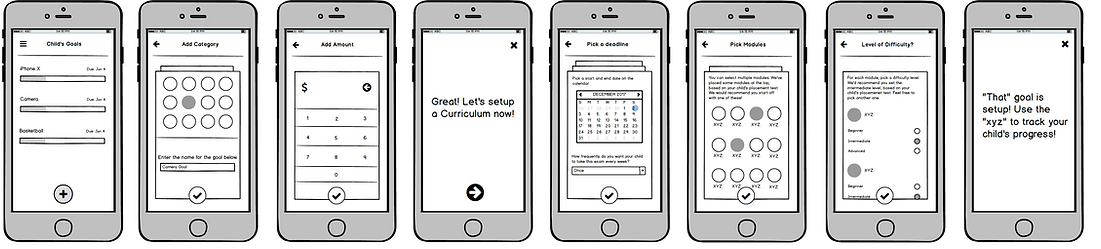

Parent Portal of Goal and Curriculum Setup

Teen Portal of Learning and Completing Goals

Modules are customized based on the teen's knowledge level after a benchmarking test, and are used to serve as recommendations in-app. Parents are also free to create customized modules for their child.

LEarn integrates into PNC's services by providing a channel for parents to participate in their teen's financial education. Parents who are PNC customers connect their PNC account to the app, which then transfers money to their teens upon achieving their educational goals.

Design Process

Competitive Analysis and Literature Review

This project challenged us to create a value exchange between the banks and teens. An initial ecosystem brain dump and literature review followed by a competitive analysis helped us get a lay of the land.

Insights: Only 2 of the big 5 have financial education platforms. Internationally we saw a use of interest free loans and account creation piggy banks. Current apps only provide a way to map spendings.

We did two in-person interviews and several phone interviews. This was accompanied by an online survey to continue to gain an insight into teen and parent needs surrounding financial education.

Through this initial research, we narrowed down our target users to early teens and their parents.

Interviews and Survey

Stakeholder Map

The primary and secondary researched informed our stakeholder map, which highlights the opportunity area. We found that parents have the most influence on teens, as well as the most interaction with them. At the same time, we noticed that there is friction here. We decided to leverage this friction to bring PNC closer to the teens.

Value Flow models

Currently, teens and parents have an informal setup around finances, with retailers influencing teens weakly, and banks having no relationship with teens. In our ideal value-flow state, parents would give regular allowance to teens, banks would be involved in their financial education, and consistent purchases at retailers would provide teens with more financial experiences.

In order to visualize our user group better, we created four user personas ranging from “ineffective parent teaching” to “effective parent teaching”. Our aim was to bring parents ineffectively teaching their teens about money to a state of effectively teaching.

Opportunity Area and Concept Making

After some secondary research on existing financial education curriculums and physical representations of financial concepts for financial education, we storyboarded three design ideas and speed-dated them with potential users.

Storyboarding and Speed-Dating

Insights

Final Concept

After validating that our test concepts, we concluded that our ideas met user needs, but users disliked the physical representations. For our final concept, we decided to incorporate learning concepts from Learning Value and Stacking, while utilizing money game app as a platform for learning.

Final Design

Branding and Visual Guideline

Our brand name is LEarn- Earn as you Learn. This is conveyed through the animation in our logo, that fills up "Earn" with a different color. Our app intends to be fun and inviting, while not veering too far from PNC’s brand, hence the use of colors inspired from PNC's brand colors.

Information Architecture and Low Fidelity Prototypes

Since we wanted the parents and teens to have their own versions of the application, we decided to create two portals.

-

Parents would be able to view their child's progress and work with them to setup goals.

-

Teens on the other hand would view goals, and finish modules to achieve the money goal set for them.

A key highlight of our application is the knowledge benchmarking test. The app initially quizzes teens to help set a baseline for the parents, as well as offer customized recommendations.

Teen Portal

Parent Portal

Here's what it finally looked like

We began with two different high-fidelity options, ultimately choosing a minimalistic look. We decided to create a visualization for how teens track their progress in the app. By allowing parents and teens to collaborate, parents can remain engaged in their teen’s financial education. Teens can solve through modules to achieve their financial goals.

Click on image to view full prototype

Click on image to view full prototype